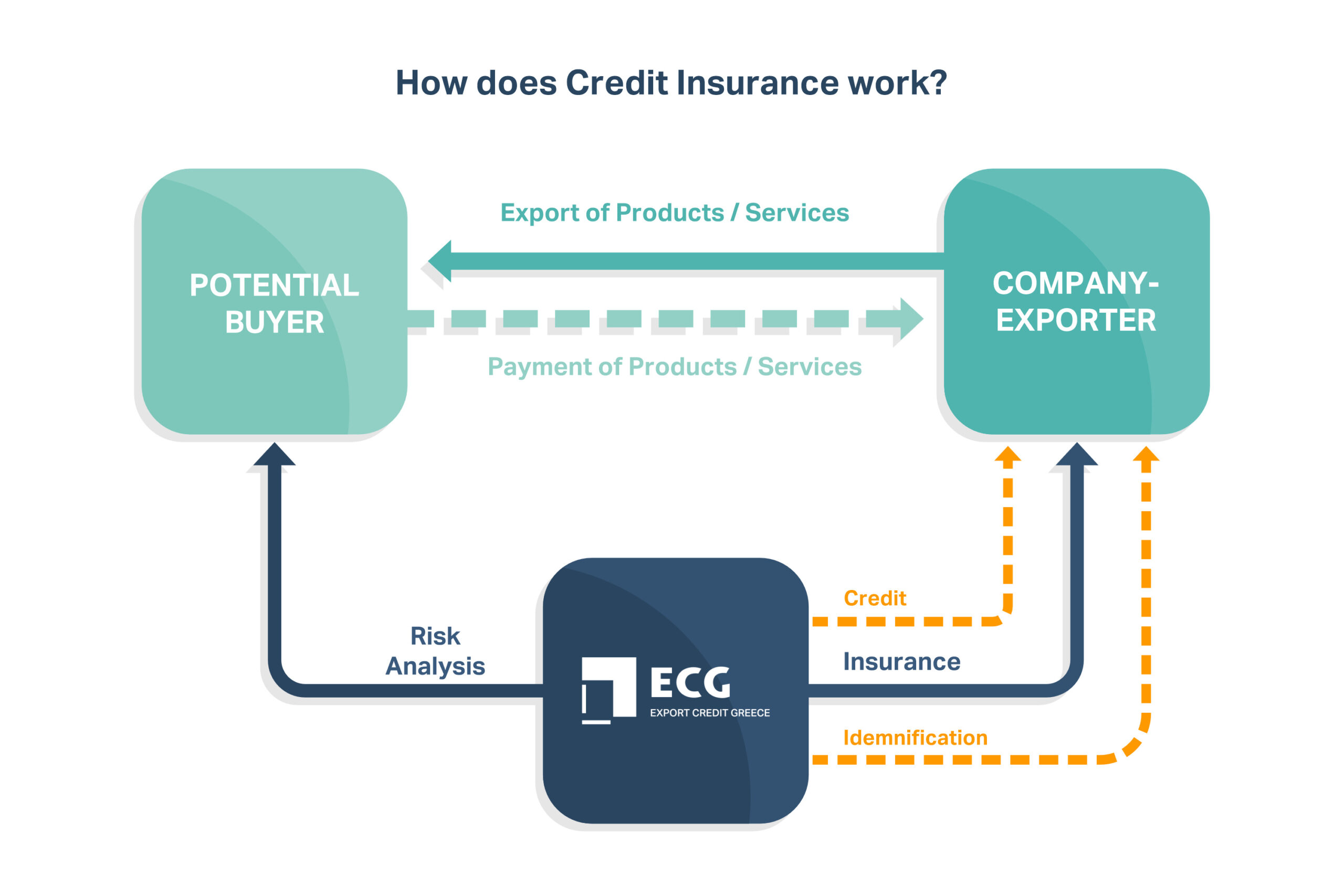

What is Credit Insurance?

Why should I get an insurance?

To operate safely

In order to have easier access to financing by the Banks

To develop improved relationships with your buyers

To increase your competitiveness and be able to more easily penetrate new markets

Our Solutions

Selective Risk

The “Start the Export” program insures one or more individual invoices and is an ideal choice for a new or an occasional exporter.

- Insured sales of products and/or services

- Coverage for commercial and/or political risks

- Credit limit assessment for each buyer

- Coverage of up to 95% to selected foreign buyers

- Pricing according to the risk of each country and the payment terms

Whole Turnover Policy

The “Global” program insures the total turnover of your exports. It is an ideal choice if you have stable sales and you wish to insure all your customers’ invoices or if you need a policy adapted to your needs.

- Insured sales of products and/or services

- Coverage for commercial and/or political risks

- Credit limit assessment for each buyer

- Coverage up to 95% of the total amount

- Policy adapted to your needs with flexibility in payment terms

Political Risk Insurance

This program is specifically designed to provide companies with the maximum possible coverage for financial losses caused by government factors, as well as political and economic turmoil. It is mainly for multinational companies wishing to strengthen their confidence in markets outside their country.

- Risk reduction

- Creation of a more stable environment for investment in developing countries

- Easier access to financing and more favourable lending conditions

- Focus on business and not on potential financial losses

- Selective Risk

-

Selective Risk

The “Start the Export” program insures one or more individual invoices and is an ideal choice for a new or an occasional exporter.

- Insured sales of products and/or services

- Coverage for commercial and/or political risks

- Credit limit assessment for each buyer

- Coverage of up to 95% to selected foreign buyers

- Pricing according to the risk of each country and the payment terms

- Whole Turnover Policy

-

Whole Turnover Policy

The “Global” program insures the total turnover of your exports. It is an ideal choice if you have stable sales and you wish to insure all your customers’ invoices or if you need a policy adapted to your needs.

- Insured sales of products and/or services

- Coverage for commercial and/or political risks

- Credit limit assessment for each buyer

- Coverage up to 95% of the total amount

- Policy adapted to your needs with flexibility in payment terms

- Political Risk Insurance

-

Political Risk Insurance

This program is specifically designed to provide companies with the maximum possible coverage for financial losses caused by government factors, as well as political and economic turmoil. It is mainly for multinational companies wishing to strengthen their confidence in markets outside their country.

- Risk reduction

- Creation of a more stable environment for investment in developing countries

- Easier access to financing and more favourable lending conditions

- Focus on business and not on potential financial losses

What is the procedure to be followed?

Step 1

Step 2

Step 3